Can Dental Insurance Help With Orthodontic Treatment?

Align Your Smile and Your Budget with Dental Insurance

Navigating the costs of orthodontic treatment can be daunting, but understanding how dental insurance can help may ease your concerns. Many patients in Ann Arbor wonder if their dental insurance will cover braces or other forms of orthodontic care. The answer varies, but in many cases, dental insurance can significantly reduce the financial burden of orthodontic treatment. This post will explore how dental insurance typically interacts with orthodontic care and how to maximize your insurance benefits.

Understanding Dental Insurance Coverage for Orthodontics

Dental insurance is designed to promote oral health by covering some costs of dental care, including prevention, diagnosis, and treatment. However, when it comes to orthodontic treatment, coverage can be more complex. Many dental insurance plans do include orthodontic benefits, but the extent of coverage can vary widely based on the plan and provider.

Key Points to Consider:

- Age Limits: Some insurance plans offer orthodontic coverage only for children and teenagers, while others extend coverage to adult orthodontic care. It’s important to check if there are age restrictions on your policy.

- Coverage Percentage: Most plans that cover orthodontic treatment provide a certain percentage of coverage, typically ranging from 25% to 50%. This is often subject to a lifetime maximum amount per individual for orthodontic services.

- Waiting Periods: Some plans may have a waiting period before orthodontic coverage becomes active. Understanding this timeframe is crucial to planning your treatment.

How to Determine Your Coverage

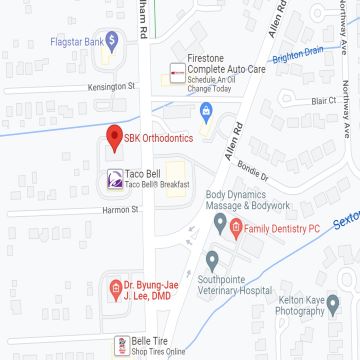

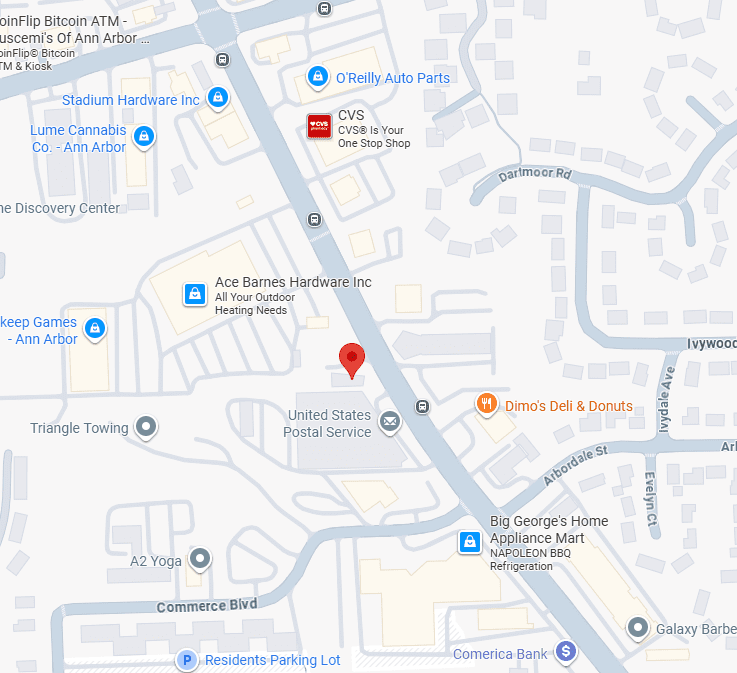

The first step in determining your coverage is to review your dental insurance policy. Look for sections that specifically mention orthodontic treatment. It’s important to understand not only the percentage of costs covered but also any caps or limits that might affect your out-of-pocket expenses. If the information in your policy documents isn’t clear, a call to your insurance provider can clarify the specifics. You can also ask your orthodontist in Ann Arbor to help verify coverage and explain how insurance benefits might reduce your treatment costs.

Maximizing Your Insurance Benefits

To ensure you are getting the most out of your dental insurance plan at SBK Orthodontics, consider these strategies:

- Annual Maximums: If your orthodontic treatment will extend over multiple years, plan your care to maximize use of annual maximums. Some patients choose to start treatment late in the year to use up one year’s benefits and then continue into the next year to take advantage of the following year’s maximum.

- Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs): If your insurance doesn’t cover all the costs, you can use funds from FSAs or HSAs to pay for orthodontic treatment with pre-tax dollars, which can save you money.

- Provider Network: Using an orthodontist who is part of your insurance provider’s network can reduce costs significantly. Network providers have agreed to lower rates with the insurance company, which can mean lower out-of-pocket expenses.

Common Questions About Insurance and Orthodontics

- Does dental insurance cover all types of braces? Coverage often extends to various types of braces, including traditional metal braces, ceramic braces, and sometimes even clear aligners like Invisalign. However, some insurance plans might only cover the least expensive treatment option or require a higher copay for more expensive alternatives.

- What about follow-up care and retainers? Post-treatment follow-ups and retainers may or may not be covered under your dental plan. This is another detail to confirm with your insurance provider, as retainers are essential for maintaining the results of orthodontic treatment.

- Can I change my coverage if it’s not sufficient? If your current dental plan doesn’t offer adequate orthodontic coverage, you might consider shopping for a new plan during open enrollment periods. Look for plans with better orthodontic benefits if ongoing orthodontic care is anticipated for you or your family members.

Let’s Explore Your Insurance Options Together!

Dental insurance can indeed help manage the costs of orthodontic treatment, making it more accessible for many patients. By understanding your coverage and planning accordingly, you can make orthodontic care more affordable. If you have questions about how your dental insurance interacts with orthodontic treatment, or if you need help planning your treatment in Ann Arbor, don’t hesitate to contact your local orthodontist. At our Ann Arbor location, we are committed to helping our patients navigate their insurance benefits and treatment options to ensure that they receive the best care possible.